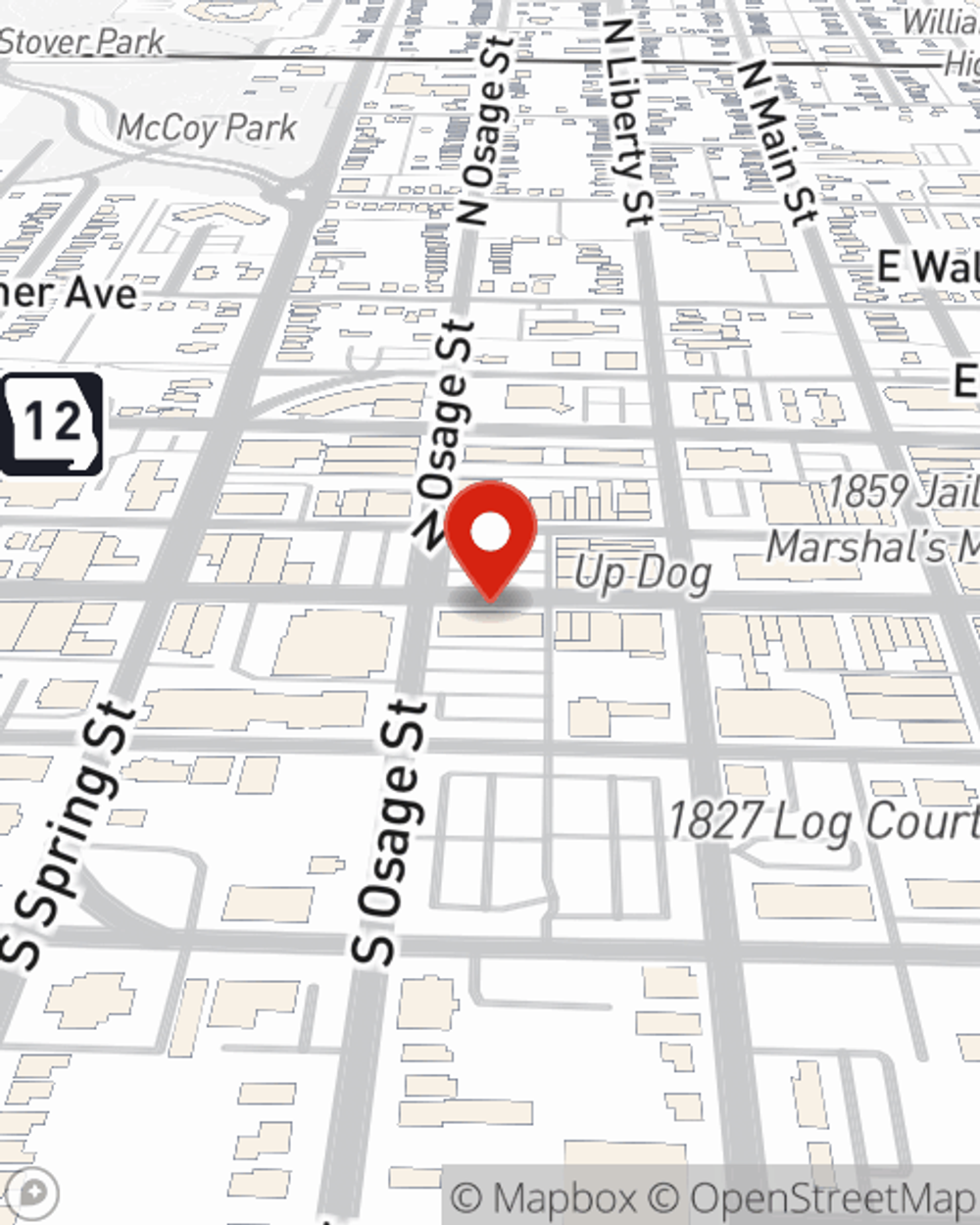

Business Insurance in and around Independence

Looking for coverage for your business? Search no further than State Farm agent Kim Downey Noble!

Insure your business, intentionally

Business Insurance At A Great Value!

It takes courage to start your own business, and it also takes courage to admit when you might need a hand. State Farm is here to help with your business insurance needs. With options like errors and omissions liability, a surety or fidelity bond and extra liability coverage, you can feel comfortable that your small business is properly protected.

Looking for coverage for your business? Search no further than State Farm agent Kim Downey Noble!

Insure your business, intentionally

Strictly Business With State Farm

Your company is unique. It's where you earn a living and also how you build a life—for yourself but also for your loved ones, and those who work for you. It’s more than just a store or a facility. Your business is a reflection of all your hopes and dreams. Doing what you can to keep it safe just makes sense! And one of the most reasonable things you can do is to get outstanding small business insurance from State Farm. Small business insurance covers a plethora of occupations like a painter. State Farm agent Kim Downey Noble is ready to help review coverages that fit your business needs. Whether you are a locksmith, a hair stylist or an insurance agent, or your business is a shoe repair shop, a pottery shop or a travel agency. Whatever your do, your State Farm agent can help because our agents are business owners too! Kim Downey Noble understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

Call Kim Downey Noble today, and let's get down to business.

Simple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Kim Downey Noble

State Farm® Insurance AgentSimple Insights®

Tenant small business

Tenant small business

As you get ready to rent space for your business, there are considerations to keep in mind.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?